How to Build a Premium Cannabis Brand

Kalos Kai Agathos [beautiful and good] The ancient Greek standard of excellence

Many cannabis firms want to appeal to premium consumers yet don’t really understand who that consumer is and what they care about.

Premium consumers are very different from their mass market cousins.

The former pays more attention to brand exclusivity, social cache, and shared values. And they view price as a signal of quality.

ATTRACTING THE DISCERNING, ELUSIVE CONSUMER

Savvy weed marketers should look beyond well-worn pop culture and sports affiliations and seek to bond with target consumers in relevant, unique and compelling ways.

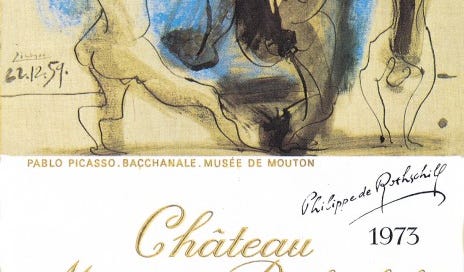

CASE STUDY: CHATEAU MOUTON ROTHSCHILD

CMR, a private and prestigious ‘first growth’ wine estate, figured out 150 years ago how to reach the premium buyer. Terroir, appellation and quality have played a part in CMR’s success but so has brand identity.

Well before brand building was a thing, CMR collaborated with leading artists of the day including Picasso, Dali, and Miro. These artists designed the labels of some famous vintages and frequented the estate to display their works of art.

CMR created the standard for how first-rate wines were presented to the World, turning the design of a bottle and label - and how it communicates what is contained inside - into an art form.

Fusing excellent wines with the creativity of talented artists has inexorably linked CMR to the values, aspirations and tastes of premium wine consumers, not to mention making art more accessible.

CMR is truly a luxury wine brand not to mention a pop culture reference. Their approach is worth considering.

David Goubert knows a thing or two about cannabis, wine and luxury marketing. David was the CEO of AYR Wellness, after 20+ years in the luxury industry (at Louis Vuitton, Neiman Marcus).

“A collab between artists and wine is a perfect example of innovative branding. A brand's equity is mainly measured by its ability to command premium prices. The best example may be Picasso in 1973 (a mediocre year in Bordeaux), where bottles still go now for about $1,000!

CMR’s following is such that their wines are as sought-after in ordinary years as in great quality years.

Your brand strategy can only be successful when it builds off a rich understanding of your DNA and brand identity. Once you have this, you can explore art or other collabs that are true to and express this identity.

These principles can be applied to Cannabis, but very few do it, or do it well.

At AYR Wellness, we quickly realized that our brands had no equity. We moved from 12 to 3 brands (classic good / better / best approach), with the focus on building brands that would have a strong & recognizable identity and could accompany consumers throughout their cannabis journey. A great example is KYND. Once well established, this brand should become an iconic and trusted brand with pricing power.”

Let’s talk about how I can help you build memorable brands.

#marketing #branding #wine #beveragealcohol #brands #art #ChateauMoutonRothschild #AYRWellness

Nice Thoughts Mitchell. The question, from someone in the trenches of this, is: are luxury cannabis brands willing to accept the minuscule segment of the market that is truly upmarket? And perhaps more importantly, are their investors game for a 7-10 year timeline in terms of any expected return, let alone the 20 or 30x? Another question, how long did those esteemed French Chateau take to mature their vines, and brands? What about Louis Vuitton or Chanel?

My experience tells me this segment is, AT MOST, 10% of the marketplace, in every state in the US at least. I cannot speak to Canada.

The financing realities facing cannabis today are to get to cash flow positivity as fast as possible, as most investor appetite for "brand building" is non-existent.

Here's a though experiment, if I were to start a super high end cannabis brand, and told you, my investor, that I was only going to sell my products to 5 dispensaries in NYC, LA, SF, Chicago, Miami, Aspen, Dallas, et al, so as to target only the most desirable and high income customers, and the goal was to lose money for many years but that one day we'd have incredible brand equity that would suddenly catapult us to the top--at the time of Federal Legalization for instance, or the abolishment of the DEA, or some other black swan, highly difficult to predict event....

would you invest in me?