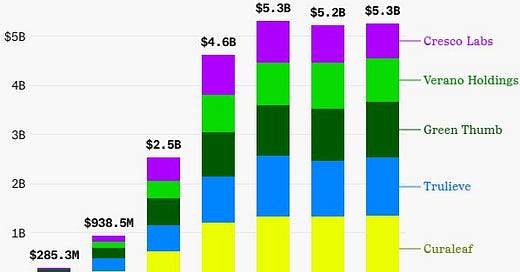

Past 3-year revenue numbers at the top 5 MSO have hit a wall.

Many cannabis professionals, investors and trolls have written off some of these large companies and their business models. Just as perplexing, others are saying the industry growth party is over.

Not so fast…

People naturally default to easy conclusions when they just read headlines, don’t undertake real analysis, or consider context.

Not on my watch

‘Hitting a Revenue’ Wall’ is a serious conclusion with far-reaching implications.

One needs to know what is going on behind the numbers. That is not possible here as these firms don’t break out their product & market revenue splits, plus no one wants to read a tome.

Still, I can suggest 7 plausible explanations and implications for the sobering numbers:

1. While MSO share is declining, smaller firm share is growing. We see this phenomenon in Canada.

This is a problem for 5 MSOs, not a market failure.

2. The illicit market could be recapturing market sales behind lower prices, higher quality or legal operators heading back into the unregulated shadows.

Anecdotally, this is happening in some markets including California and Michigan.

3. The MSO product mix is not keeping pace with market trends.

Their brands could be underdeveloped in growing categories (e.g., hemp THC, edibles and pre-rolls) while being overdeveloped in the declining flower segment.

4. Flat revenues may be a function of higher unit volumes being offset by declining unit prices.

Volume increases are good as they drive scale economies, lower inventories, and positive investor press.

5. Core consumers – regular buyers, flower consumers, the young – and ‘trial buyers’ could be maxed out.

However, there remains plenty of other emerging segments to target not to mention innovation-driven ‘blue ocean’ opportunities to explore.

6. Some MSO revenues could be concentrated in States that were hitherto islands of legalization.

As neighbouring States legalize, these islands lose some tourist/smuggling sales, taking MSO revenues down with them.

7. Occam’s Razor.

Flat numbers are what they appear: a top 5 MSO growth problem with ramifications for their go-to-market strategy, brand portfolio and operating model.

If I was going to solution these issues, I would look deeper into all the data and ask some hard questions, such as:

--> What are the root causes of underperformance?

--> Who in the sector is growing, and why?

--> What strategic assumptions need to be challenged?

--> Is growth, revenue, or something else the right KPI?

--> Where do we need to fundamentally change?

Call me. I give companies a fact-based, objective view of their markets & consumers to help solve their challenging strategic, cost & growth problems.

#MSOS #brands #growth #strategy #revenue